Bookkeeping Spreadsheets with Cash Accounting

The best solution for small businesses using Cash Accounting - Your Annual licence for just ...

Regular price

£79.99

£89.99

Sale

Our 2026 Bookkeeping Spreadsheets are now available and MTD Ready. Choose from VAT, Flat Rate VAT or non VAT. The perfect solution for all small businesses.

Using Bookkeeping Spreadsheets and the Cash Accounting method for recording your business transactions and VAT records [both Standard VAT and Flat Rate] is the easiest way to 'do the books'.

HMRC Introduced this scheme in 2012 together with the ‘Simplified Expenses’ initiative.

Maintaining your bookkeeping records is now far less complicated.

Our range of Bookkeeping Spreadsheets is ideal if your small business uses the HMRC- Cash Accounting rules.

This applies to both your Annual Self Assessment returns and if you are VAT registered and use the HMRC Cash Accounting VAT Scheme [both Standard and Flat Rate].

Yes, our products are all MTD ready.

Our Excel based spreadsheets are designed to conform with HMRC standards and are ‘so simple to use’

there are 3 good reasons for this,

1. you don’t need any accounting knowledge,

2. you don’t have any ‘set up’ work to do,

3. all you have to do is enter your starting bank balances, and

you’re ‘Good to Go’

and with over 6,000 bookkeeping spreadsheets already sold,

Mr.SpreadSheet is the ‘go to solution’ for

'inexpensive, easy to use, bookkeeping spreadsheets'

We first designed the cash accounting range of bookkeeping spreadsheet templates to meet the needs of various small business clients who asked the question ’what accounting software shall I use’.

Most of the readily available were far too complicated and expensive.

Our recommendation to our smaller [non VAT registered] clients was to use the Cash Accounting method and to help them we designed a simple cash accounting product to meet their needs.

So, if your turnover is under the VAT Threshold [currently £90,000] this could be the product for you.

For those smaller businesses [including Self Employed professionals ] who are over the VAT Threshold,

The product was enhanced to conform to the Cash Accounting VAT Scheme [including the Flat Rate Scheme].

So, why is it suitable for you …

Well here are 11 good reasons

1. It works

2. It’s simple

3. It doesn’t cost a lot

4. We as accountants, support the product

5. Simple design makes for easier data entry

6. HMRC formats [uses HMRC coding conventions]

7. 90% of the set up is already done for you

8. MTD ready

9. Professional Accounting help and support

10. Full 'How to Use' guides and documentation

11. Ongoing support via newsletters and Social Media channels

Did you know ...

That if your turnover is less than the VAT threshold then you can take advantage of the ‘Three Line Accounts’ method of disclosing your self employed income for tax purposes. *

Yes, that right, if your turnover [self employed only] is less than £90,000,

then all you need disclose to HMRC are the values of

(1) your business Turnover,

(2) your business expenses and

(3) the net profit or loss. [Sales less Expenses]

How simple is that …

Therefore if you keep adequate business records and can fully support and validate all of your business transactions [using our cash accounting templates] you can complete your business tax returns HMRC Form SA103S for yourself.*

-

Caveat - Obviously, as practicing accountants ourselves, we would strongly advise that you consult with an accountant beforehand. They will be able to advise you on business taxes and available benefits etc. If you need accounts for the bank or other organisations, then a full set of accounts [done by your accountant] would be necessary.

so, let's take a more detailed look at the Cash Accounting range ...

Software Design and Features

Small Business Cash Accounting Template is designed in Monthly format.

Starting at Month 1 you have 12 identical worksheets covering your Accounting Year.

Each worksheet records ALL your business transactions for that month.

This is what your Monthly worksheet looks like.

It is separated into a Header Section, followed by the Data Section and ends with a Monthly Summary Section.

The Monthly Worksheet

The system uses a combination of Drop Down Boxes to make data entry simple and error proof.

Each monthly worksheet caters for ALL your transactions; the software allocates one line to each entry.

You select the appropriate transaction type from the Drop Down Box and then complete the line.

Your data is coded to conform to HMRC formats, you select the appropriate analysis from another Drop Down Box and the software completes the posting. Thus eliminating the potential for errors.

VAT is calculated automatically based on the VAT Rate selected. You have the ability to overwrite the automatic calculation if necessary.

It's that simple !

The following three screenshots show this process.

- Select your Transaction Type

- Select your Analysis

3. Select your VAT Rate [if applicable]

On each Monthly worksheet you can perform selective Sort routines and use Excel's 'Filtering' tool to perform advanced analysis of your data.

Once each line has been completed the software uses Excels powerful formulae to update the following :

- Income and Expenditure Report

- Your VAT Returns

- Monthly Profitability & Sales Summaries

- Bank, Cash and Credit Card balances

- Customers & Suppliers balances

Thus ensuring that your accounts are both accurate and up to date.

The software also automatically completes other tasks which provide the following:

(1) A consolidated Year's Data worksheet

(2) A separate worksheet that show ALL of the year's transactions on ONE worksheet

(3) A special report for your accountants which will enable them to easily upload you data into their systems.

Finally the system provides you with additional worksheets for VAT and for you to record other financial data for 'Year End' purposes.

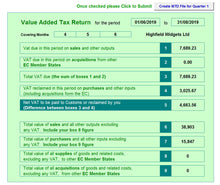

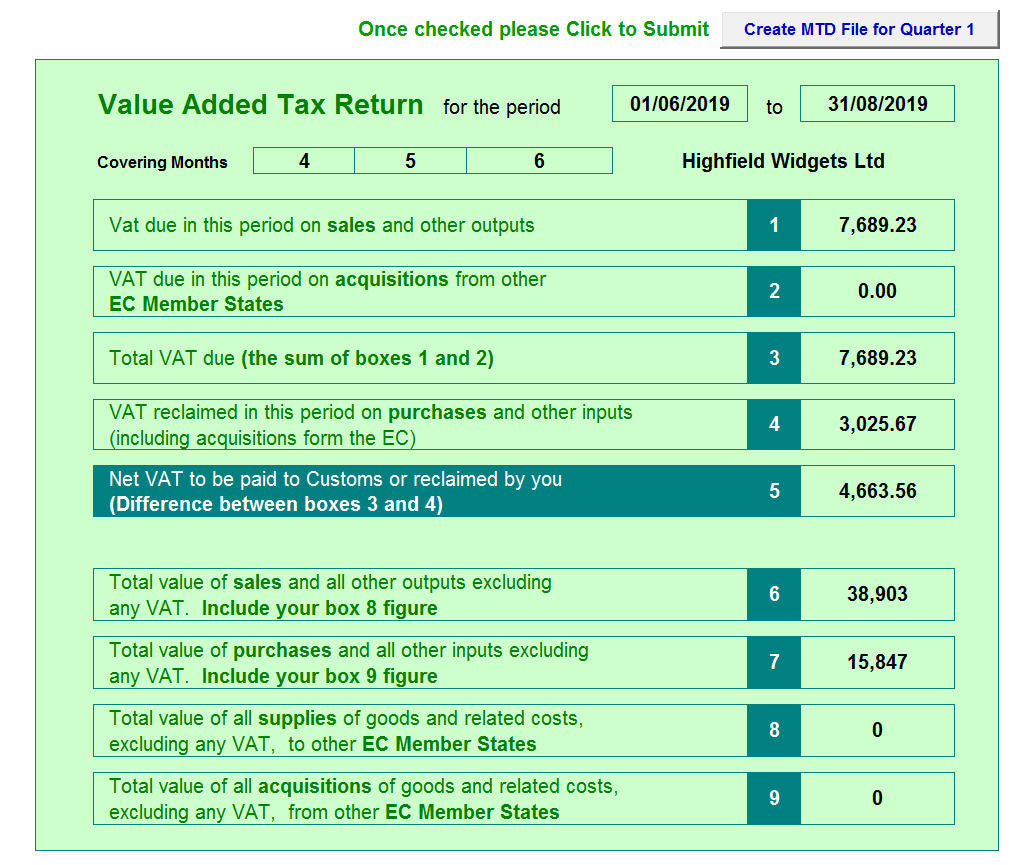

(1) The VAT Returns - Now with MTD Bridging Software for HMRC Filing

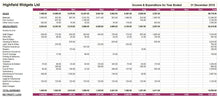

(2) Income and Expenditure Report - Across the complete year

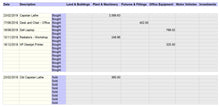

(3) The Fixed Assets Schedule

(4) Year End Stock Listings

(4) Year End Debtor and Creditor Schedules

Set Up, Year End and Backups

Many people are worried about how to Set Up accounting software and are concerned about how to complete the Accounting Year End procedures.

The Cash Accounting Template system manages this with ease.

To Set Up your accounts you just follow the Step by Step guide and fill in the relevant information in the various worksheets. It should take you no more than 15 minutes and then you are ready to go.

At the Year End you need to supply your accountant with additional information, the system notes will guide you effortlessly through providing details of Assets, Year End Debtors and Creditors, Bad Debts and Depreciation.

We have not forgotten the importance of data security; the User Guide provides comprehensive details on how to take regular backups of both the software and your data.

here's some important Additional information ...

This bookkeeping template is suitable for both VAT and NON VAT Registered Self Employed Professionals, Sole Traders, Partnerships, Clubs, and 'Not for Profit Organisations' who are using the CASH ACCOUNTING bookkeeping method.

To use this spreadsheet template you must have the full Microsoft Excel Software 2010, 2013 or Office 365 [Not the Starter Edition or Open Office equivalents] installed.

This product is sold on an Annual Licensing Agreement which means that a new licence is required for each tax year.

If you are in any doubt about the suitability of the software for your business, or if you have any other questions,

then please email us at support@MrSpreadSheet.co.uk.

If you are wondering what the benefits of CASH Accounting are, then,

a few year's back a wrote this article on the 'Cash Accounting method'

It is as true today as it has ever been ...

Many practicing accountants recommend the Cash Accounting VAT Scheme.

The simple bookkeeping structure and positive cash flow benefits make this an ideal accounting system for many smaller businesses.

Using conventional Standard VAT accounting you will pay VAT on any invoices you have issued, even if you have not received the payment, and you reclaim VAT on any invoices you have received, even if you have not yet paid your supplier.

The Cash Accounting Scheme differs from this. You pay VAT on your sales ONLY when your customers pay you and you reclaim VAT on your purchases ONLY when you have paid your suppliers.

Advantages and disadvantages

The HMRC website has the following to say:

The Advantages - Using this scheme may help your cash flow, especially if your customers are slow payers. You do not need to pay VAT until you have received payment from your customers. So if a customer never pays you, you don't have to pay VAT on that bad debt as long as you continue to use the scheme.

Disadvantages - Depending on your own circumstances, there may be some disadvantages to using the scheme as you cannot reclaim VAT on your purchases until you have paid your suppliers. This can be a disadvantage if you buy most of your goods and services on credit.

If you regularly reclaim more VAT than you pay, you will usually receive your repayment later under cash accounting than under standard VAT accounting, unless you pay for everything at the time of purchase.

If you start using cash accounting when you start trading, you will not be able to reclaim VAT on most start up expenditure, such as initial stock, tools or machinery, until you have actually paid for those items.

If you leave the scheme you will have to account for all outstanding VAT due including any bad debts.

There are some minor additional accounting and compliance requirements as you will still need to keep a record of year end debtors and creditors.

Why choose Cash Accounting

For many small businesses the great advantage of a cash accounting spreadsheet based system is that it is easy to understand. This simplicity encourages attention to detail in the recording of business transactions and this serves to enhance the quality of the accounting records.

There is little mystique in the bookkeeping, you only need record transactions when you either receive or pay for them.

In an earlier article 'Accounting Software - are bookkeeping spreadsheets the answer for small businesses.' I outlined the importance of maintaining accurate and fully reconciled Cash Book records as one of the essential ingredients in maintaining a good spreadsheet based bookkeeping system.

The bookkeeping records needed are exactly the same as those for the Cash Book and can easily be catered for!

Cash accounting can be viewed as an opportunity for some small businesses to take advantage of a simplified bookkeeping system and at the same time improving their cash flow.

Additional information and small print

Mr. Spreadsheet is a registered trading name and division of Heron Accounting Services, Poole, Dorset. This software is protected by international copyright and is sold on a single-user license agreement for the use by the licensee or licensees business only. Unlawful copying and distribution will result in prosecution.We make no warranty or representation, either express or implied, with respect to this software and documentation, their quality, performance, merchantability, or fitness for a particular purpose. This software is licensed ‘as is’, and you, the licensee, by making use thereof, are assuming the entire risk as to their quality and performance. In no circumstances will we be held liable for direct, indirect, special, incidental or consequential damages arising out of the use or inability to use the software or documentation.