Accounting SpreadSheets - the EASY Range

The perfect solution for VAT Registered small businesses - Your Annual Licence for just ...

Regular price

£79.99

£89.99

Sale

How do I keep accounting spreadsheet records using Excel ...

This is a question I get asked by many small businesses and self employed professional clients who need a simple bookkeeping solution and are reluctant to pay for expensive accounting software.

Please read on - because today I am going to answer that question for you.

As a practicing accountant I have been designing, installing, training and setting up accounting spreadsheets and small business software for the past 30 years.

In my experience most ‘off the shelf’ products and many cloud based accounting solutions are ‘way too complicated’ for the majority of small businesses.

[Just setting up the system is often a nightmare.]

And here's why ...

The Federation of Small Businesses tells us that 60% of all small businesses are Sole Traders.

YES - that's right, most of us are small and uncomplicated

SO - we DO NOT need complicated accounting software

Let me ask you 3 simple questions ...

- Do you really want to spend lots of time ‘working out’ how to use complicated accounting software.

- Do you want to spend hours in ‘setting up’ your system [and often getting it wrong because it is too complicated]

- Do you want to spend a lot of money and end up frustrated.

No, I don't think so ...

Please don't get me wrong, the likes of Sage, QuickBooks and today's cloud based solutions are great.

Great, that is, unless ...

- You know what you are doing

- You are an accountant and know how to do it

- You understand the 'structure' of an accounting system

- You are a larger business who needs these advanced features

In my experience MOST small businesses 'DO NOT NEED' and 'DO NOT WANT' all of this.

'What is required is an out of the box, ready made solution that is easy to use'

And that's it ...

Now here’s the good news

Our simple [but comprehensive] accounting spreadsheets are great alternative solution.

what are the benefits ...

Let me guide you through 7 of the main benefits, and afterwards I will show you, not only how the system works, but:

I will provide you with a detailed guide on 'How to Keep your Accounting Records', and

As a BONUS I will give you 5 tax saving tips that if applied correctly will easily cover the costs of your purchase.

7 good reasons why you should buy this product ...

They are designed to conform with HMRC formats and 90% of the set up routines are already done for you. The product is also Making Tax Digital ready.

The products are used by my small business clients and by over 6,000 other small businesses.

I personally support the product and will normally be your first line of help.

I will answer your 'Accounting Questions/Queries' as well as spreadsheet issues.

As it is a spreadsheet there are no compatibility issues with your accountants software. Just send them the 'Excel file' at the end of the year.

Finally, I believe that you won't find this level of support from any mainstream vendor.

We pride ourselves on offering a personal service.

So, let’s look at the product in more detail …

Software Design and Features

Our Small Business Accounting Spreadsheet Software is designed in Monthly format.

Starting at Month 1 you have 12 identical worksheets covering your Accounting Year. Each worksheet records ALL your business transactions for that month.

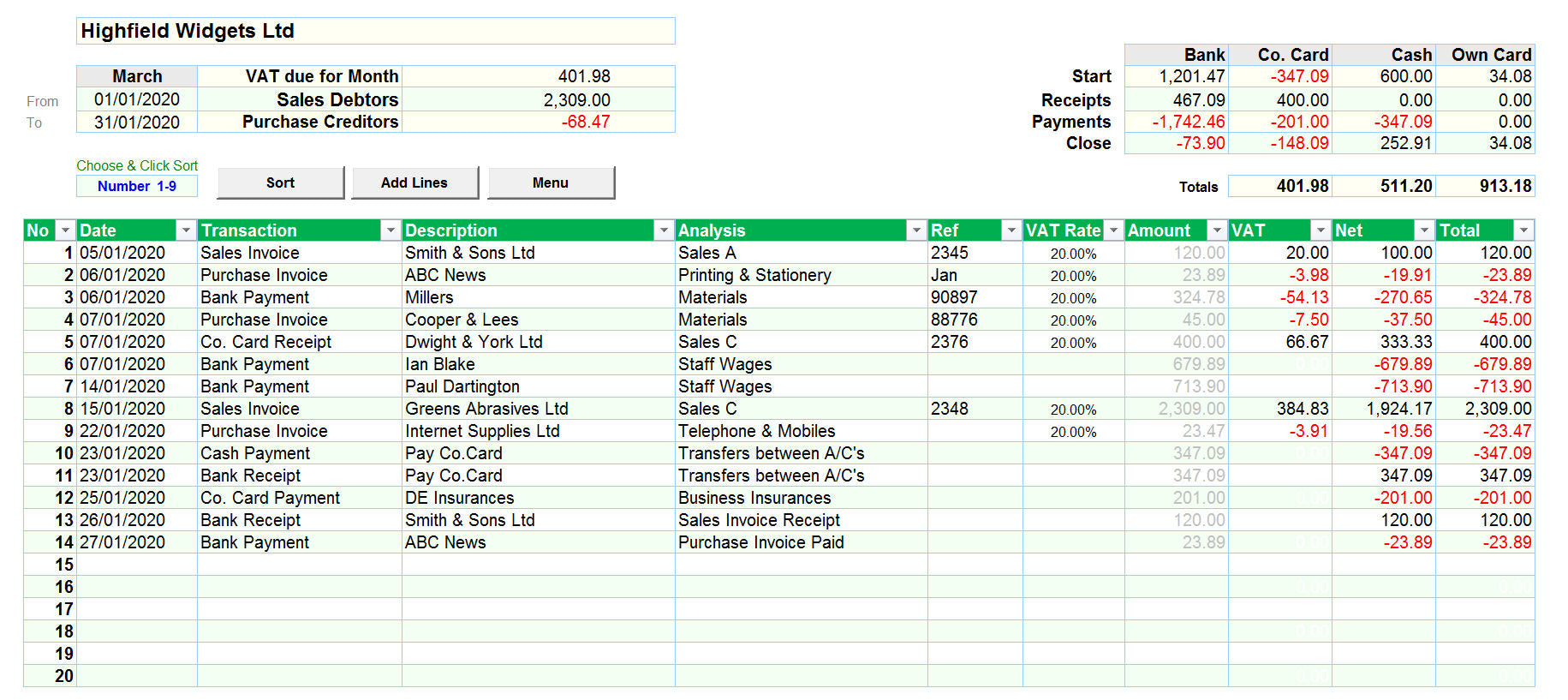

This is what your Monthly worksheet looks like.

It is separated into a Header Section, followed by the Data Section and ends with a Monthly Summary Section.

The Monthly Worksheet

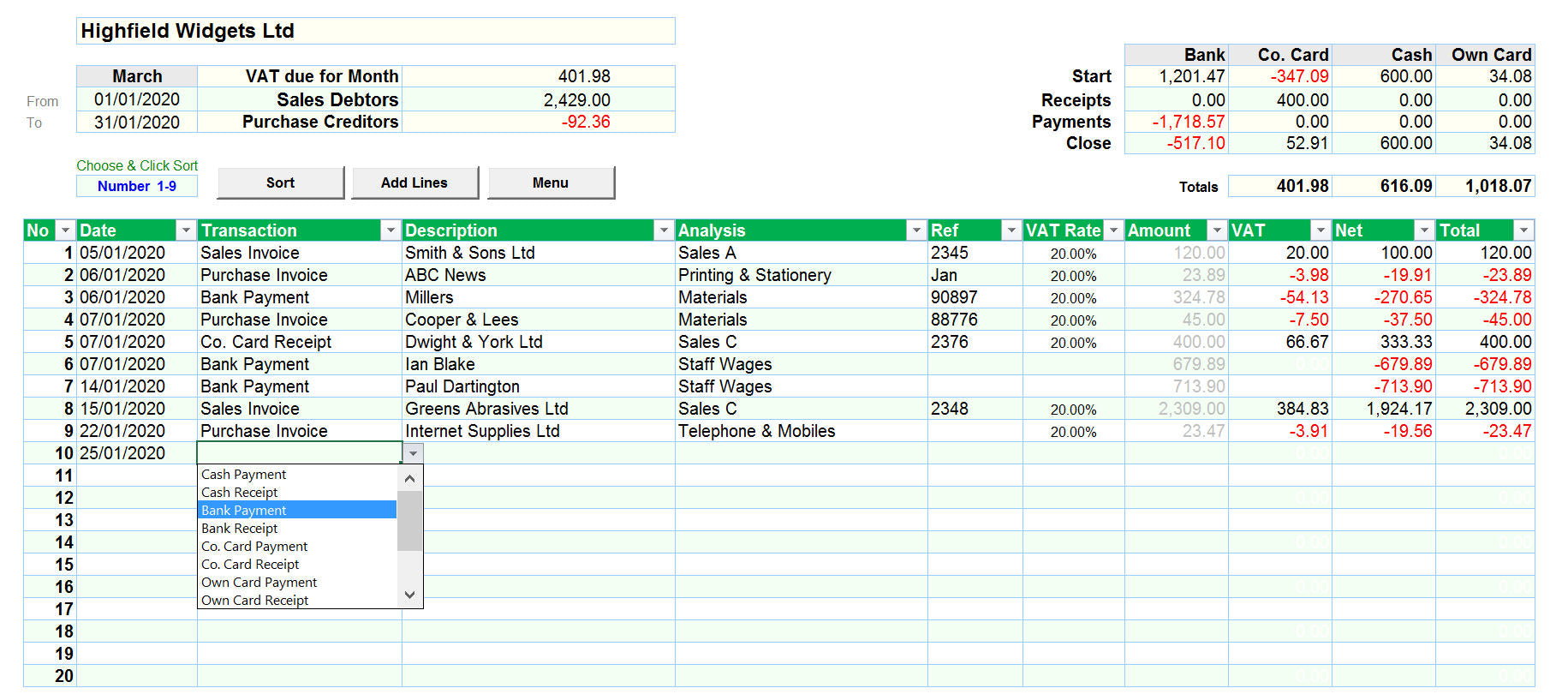

The system uses a combination of Drop Down boxes to make data entry simple and error proof.

Each monthly worksheet caters for ALL your transactions; the software allocates one line to each entry.

You select the appropriate transaction type from the Drop Down Box and then complete the line.

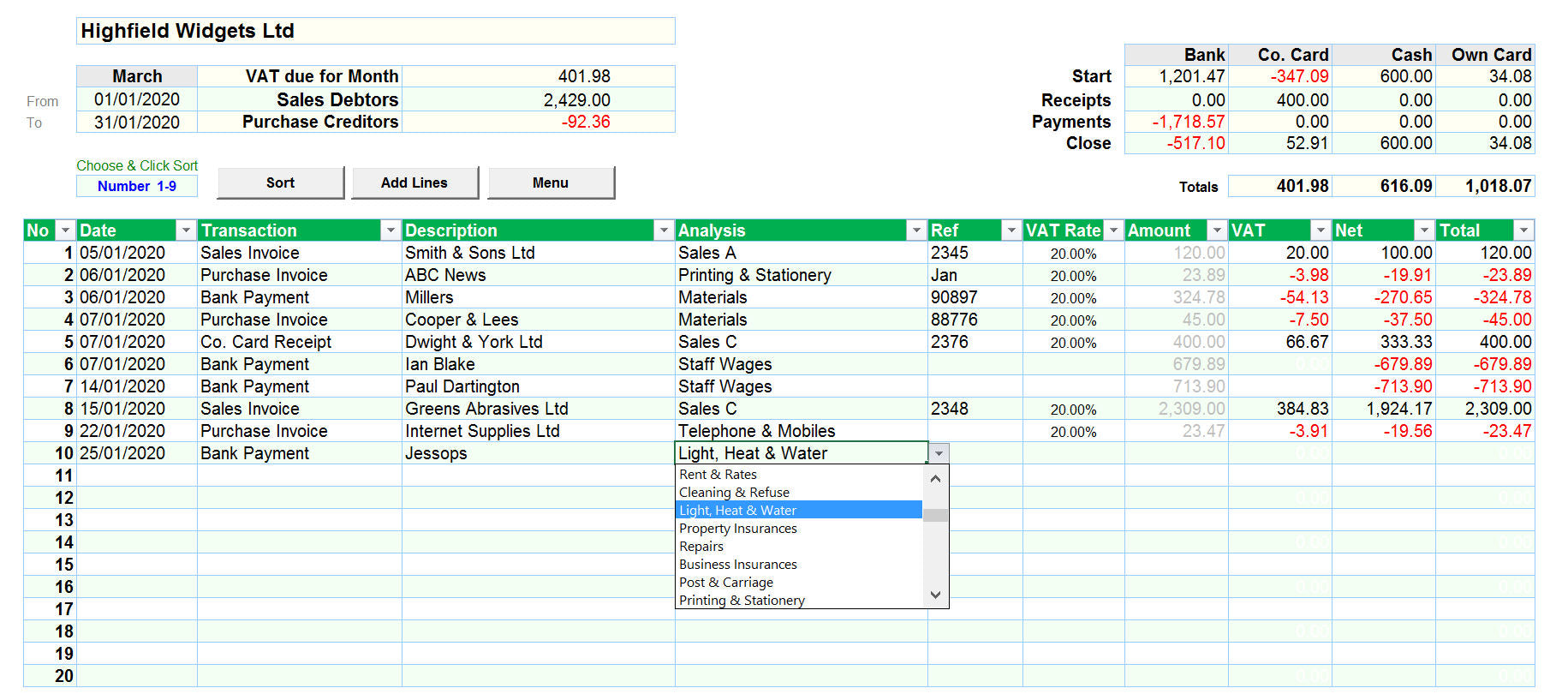

Your data is coded to conform to HMRC formats, you select the appropriate analysis from another Drop Down Box and the software completes the posting.

Thus elimination the potential for errors.

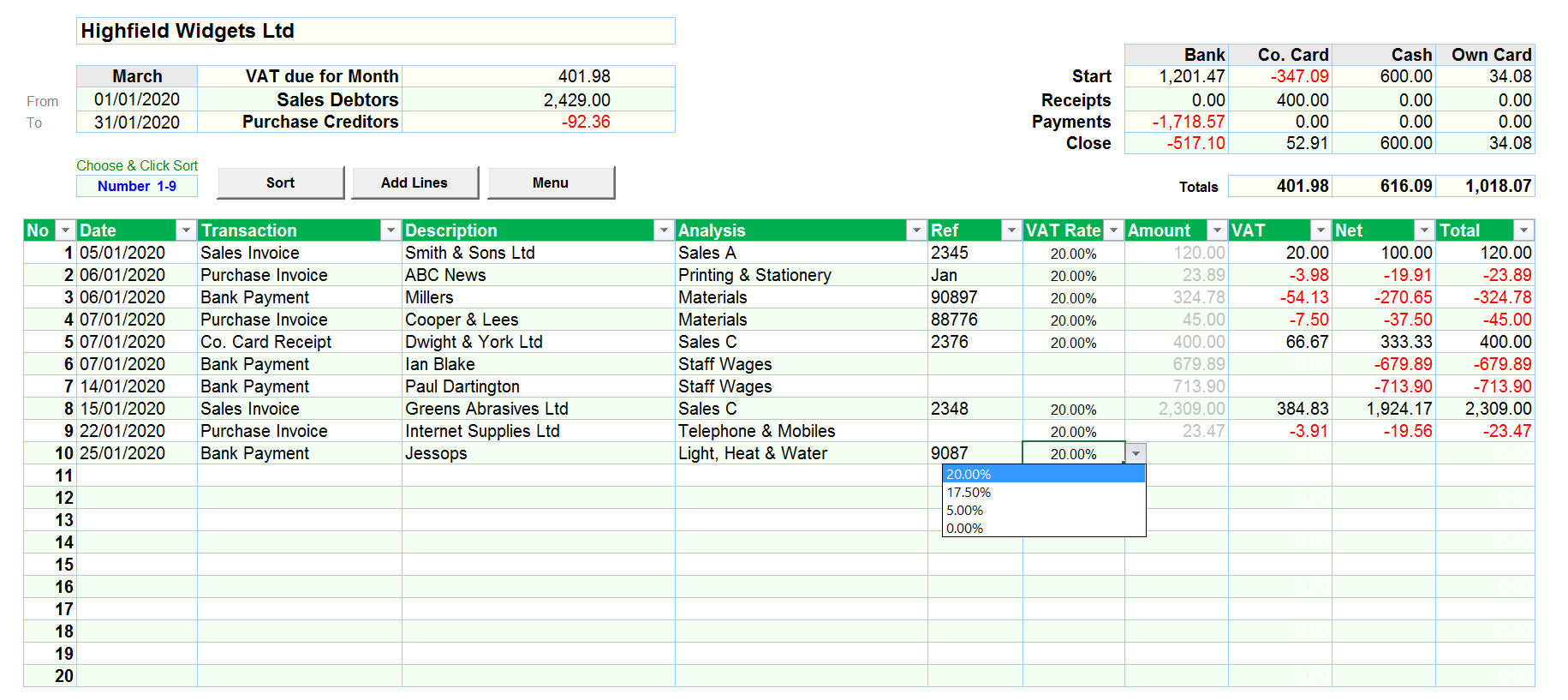

VAT is calculated automatically based on the VAT Rate selected. You do have the ability to overwrite the automatic calculation if necessary.

It really is that simple !

The following three screenshots show this process.

- Select your Transaction Type

2. Select your Analysis

3. Select your VAT Rate

On each Monthly worksheet you can perform selective Sort routines and use Excels 'Filtering' tool to perform advanced analysis of your data.

Once each line has been completed the software uses Excels powerful formulae to update the following :

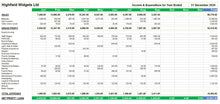

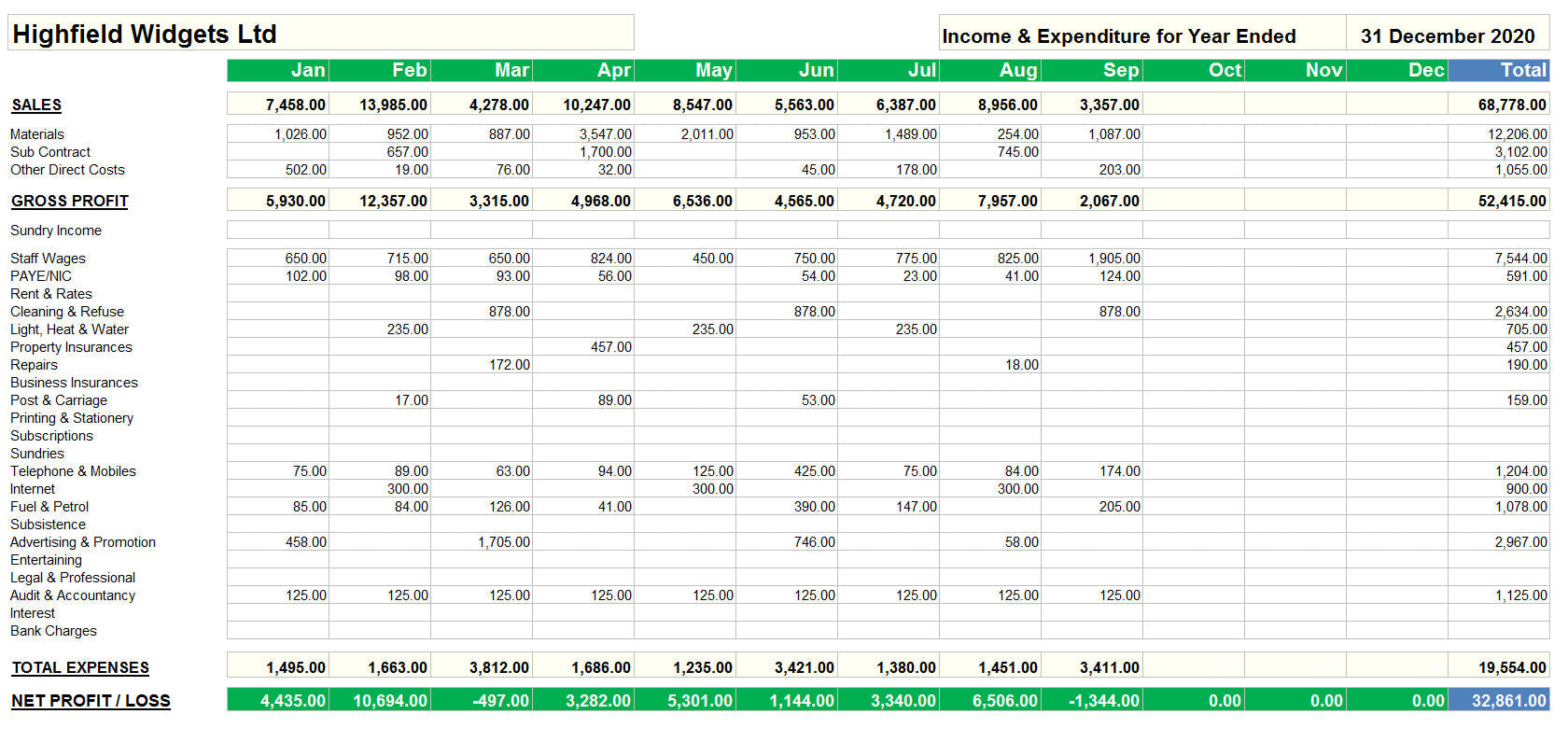

- Income and Expenditure Report

- Monthly Profitability & Sales Summaries

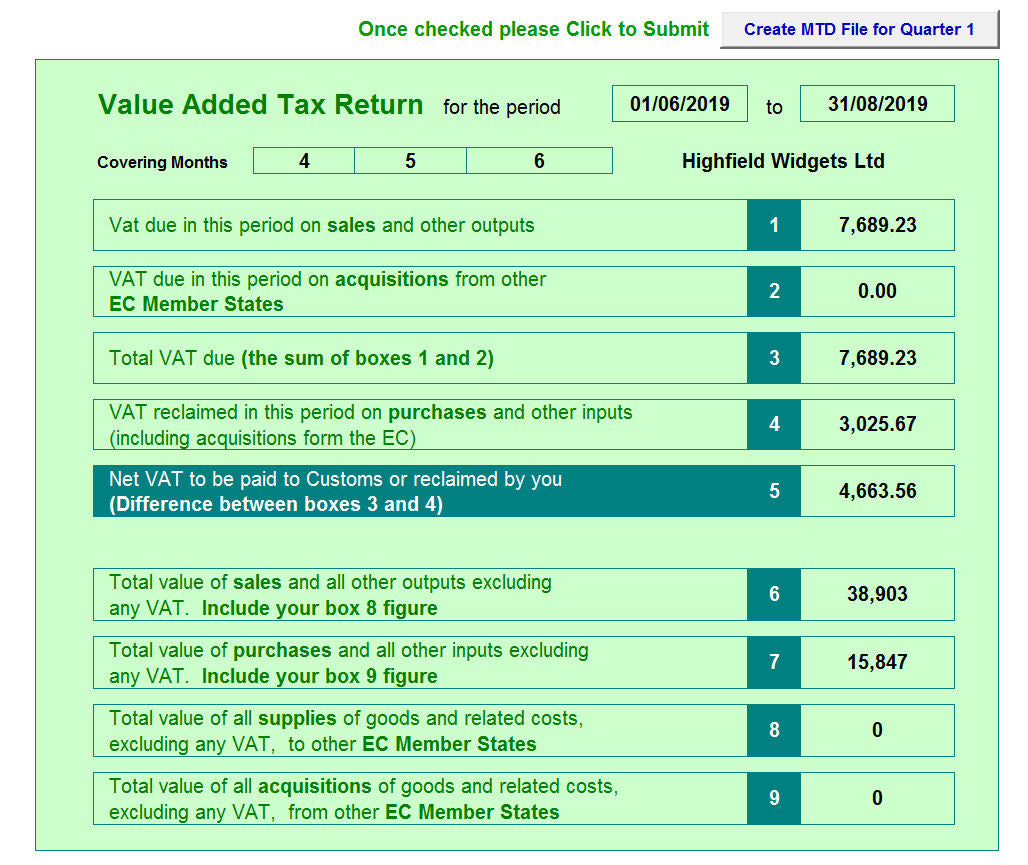

- VAT Returns

- Bank, Cash and Credit Card balances

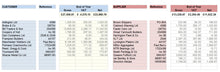

- Customers & Suppliers balances

(see screenshots below)

Thus ensuring that your accounts are both accurate and up to date.

The software also automatically completes other tasks which provide the following:

- A Consolidated Year's Data worksheet

- A separate worksheet that shows ALL of the years transactions on ONE worksheet

- A special report for your accountants which will allow them to easily upload your data into their systems

Finally the system provides you with additional worksheets for you to record other financial data for 'Year End' purposes.

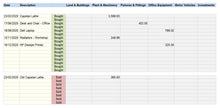

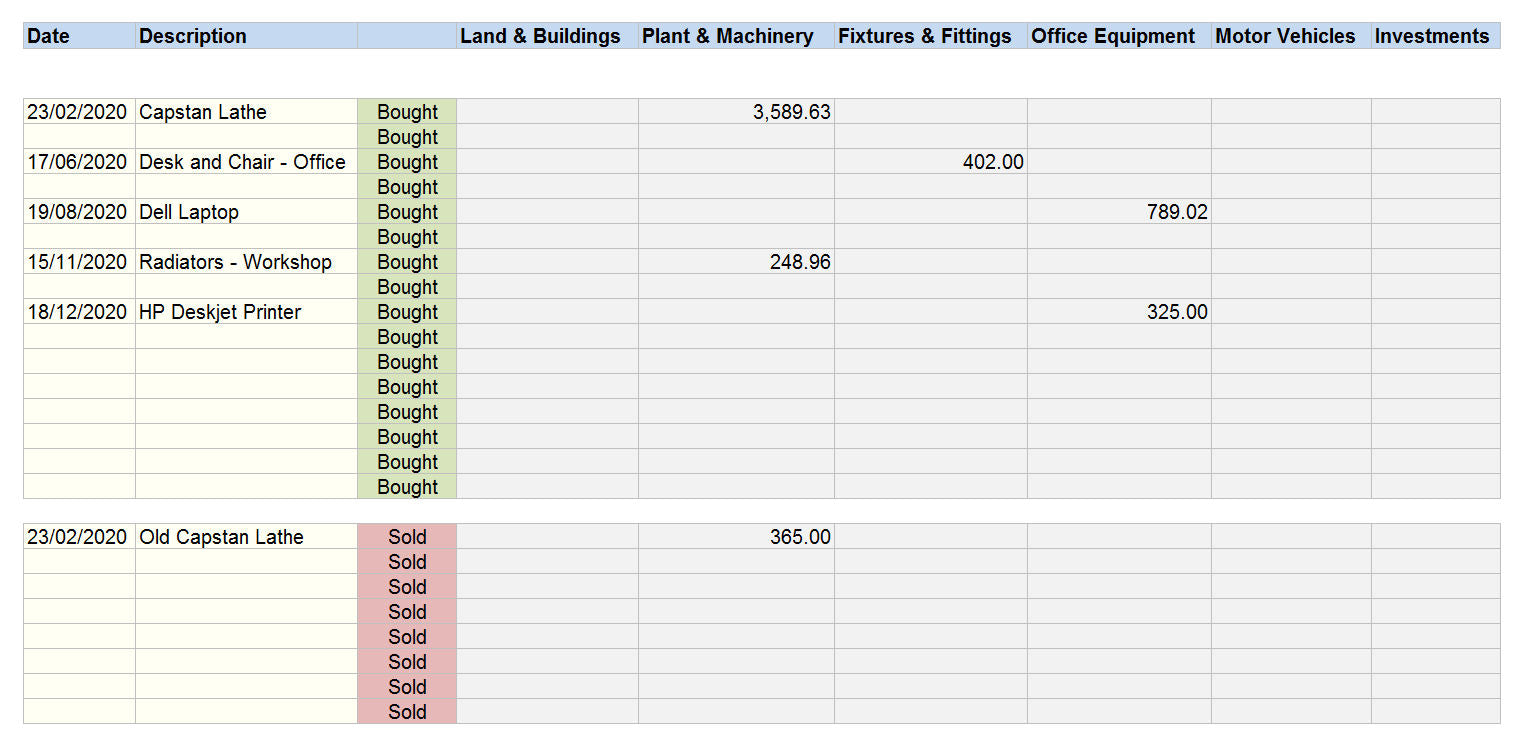

- Fixed Assets Schedule

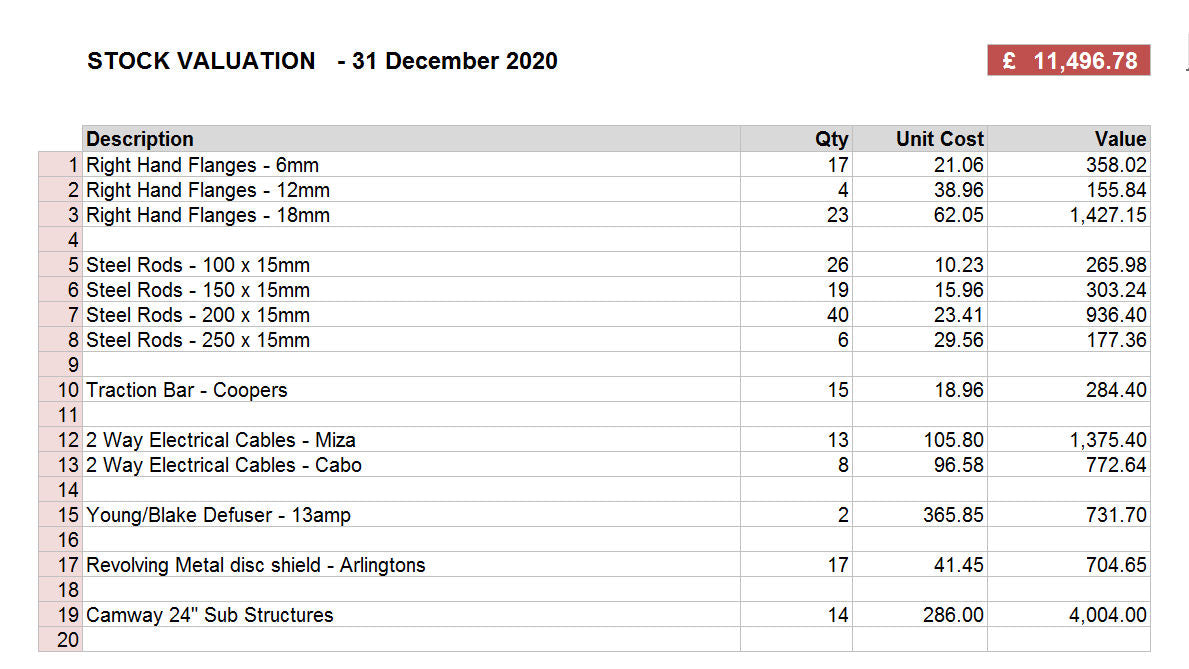

- Year End Stock Schedule

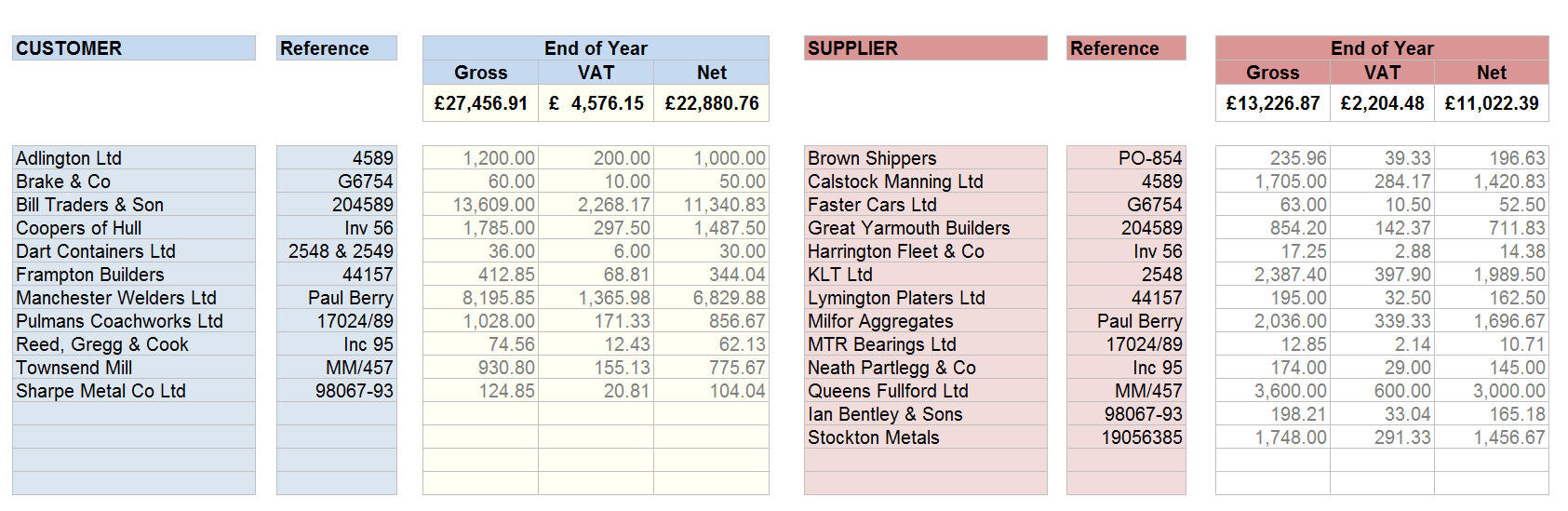

- Year End Debtors

- Year End Creditors

(see screenshots below)

- Income and Expenditure Report and Graph

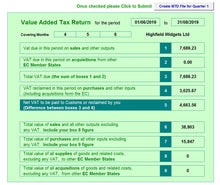

The VAT Returns

3. Fixed Assets

4. Year End Stock

5 . Year End Debtors and Creditors

Set Up, Year End and Backups

Many people are worried about how to Set Up accounting software and are concerned about how to complete the Accounting Year End procedures.

The Small Business Accounts Software manages this with ease.

To Set Up your accounts you just follow the Step by Step guide and fill in the relevant information in the various worksheets.

It should take you no more than 15 minutes and then you are ready to go.

At the Year End you need to supply your accountant with additional information, the system notes will guide you effortlessly through providing details of Assets, Year End Debtors and Creditors.

We have not forgotten the importance of data security; the User Guide provides comprehensive details on how to take regular backups of both the software and your data.

let me give you 11 Good Reasons to purchase

- Designed by a practicing accountant

- Supported by accounting personnel

- 90% of the set up is already done – you’re good to go

- Simple structure

- Includes a ‘how to keep your books’ system

- Accounting help as well as product support

- Ongoing business support via newsletter and channel subscriptions

- At the Year End – just send a copy to your accountant

- No worries about compatibility [as it’s a spreadsheet]

- Over 6,000 small businesses have bought

- Monthly checklists

I hope that I have been able to demonstrate that Accounting Spreadsheets are a ‘VIABLE’ and ‘Cost effective’ way for small businesses to keep their accounting records.

Using data provided from this range of Accounting Spreadsheets you can submit your Self Assessment [SA103 - Business Income] to HMRC.

Similarly, if you are VAT registered the spreadsheet prepares all of the data necessary submitting your returns.

Oh, and Yes, our products are all MTD ready.

Sold on an Annual Licencing Agreement

[You will need a new licence for each tax year]

3 Great Versions are available – On ordering just select from either

- Non VAT Registered

- Using the Standard Cash Accounting VAT Scheme

- Using the Flat Rate Cash Accounting VAT Scheme

and now you are 'God to Go'

Additional information ...

This version is suitable for VAT Registered Sole Traders, Partnerships, Clubs, 'Not for Profit Organisations' and Limited Companies.

To use this software you must have the full Microsoft Excel Software Version 2010, 2013 or Office 365 [Not Starter Editions or Open Office equivalent] installed.

We believe that there is no comparable Excel based small business software that offers so much at this price.

This product is sold on an Annual Licensing Agreement

If you are in any doubt about the suitability of the software for your business, or if you have any other questions,

then please email us at support@MrSpreadSheet.co.uk

and finally,

here is an article I wrote a few year ago, explaining just why accounting spreadsheets are 'the ideal fit' for may small businesses.

Thank you very much for reading about us.

' Many self-employed individuals will start off their business bookkeeping records on an accounting spreadsheet.

The popularity of spreadsheets such as Microsoft’s Excel means that it is often the first ‘financial tool’ a businessman reaches for. But, is it the right one?

In a previous article ‘Accounting Software – are bookkeeping spreadsheets the answer for small businesses’ I examined the ‘bare minimum’ bookkeeping requirements for a small business accounting spreadsheet and outlined what controls needed to be in place to augment these records.

The article concluded that a properly designed and fully reconciled Cash Book accounting spreadsheet coupled with a Sales Day Book and a Purchase Day Book could form the basis of a workable bookkeeping solution.

For the self-employed businessman this means making sure that your records will HELP rather than HINDER the work of your accountant. Many accountants find that they ‘have to do the work again’ because of the inadequacy or inaccuracy of the bookkeeping data presented to them.

I would strongly advocate showing your accounts spreadsheets to your accountant at an early stage and be prepared to implement any changes he might suggest.

What should you include on your accounting spreadsheets?

There are many examples of good bookkeeping spreadsheets, and all of them will incorporate the following essential data for EACH of your business transactions.

- The transaction Date

- The transaction TYPE(Purchase Invoice, Bank Payment, PayPal Receipt etc.)

- Who is the transaction with (Customer Name, Supplier Name etc.)

- The transaction Reference(Invoice Number, Cheque Number, etc.)

- An ANALYSISof the transaction (Sales, Rent, Wages, Interest Paid etc.)

- The GROSStransaction value

- The VATvalue (if applicable) of the transaction

- The NETvalue (after VAT) of the transaction

- The STATUSof the transaction (Invoice Paid, Bank transaction matched etc.)

So, a series of three bookkeeping spreadsheets designed in a monthly columnar format with these column headings is a good starting point:

DATE, TYPE, NAME, REFERENCE, ANALYSIS, GROSS, VAT, NET and STATUS.

Each business transaction should be listed on a new line and should be sorted chronologically.

To help your accountant, I would recommend that you use a standard naming convention for your transactions analysis. (Sales, Rent, Wages, Interest Paid etc.)

After you have entered your basic information onto the accounting spreadsheets, you should then examine your bank, credit card and other statements to make sure that you have not missed any transactions. If you have, then these need to be recorded on your listings.

You need to make sure that the whole accounting spreadsheet BALANCES. Add up the individual COLUMN totals and then add up the individual ROW totals, they should be the same.

Finally , send your first months accounting worksheets to your accountant for correction and approval. '

Additional information and small print

Mr.Spreadsheet is a registered trading name and division of Heron Accounting Services, Poole, Dorset.

This software is protected by international copyright and is sold on a single-user annual licence agreement for the use by the licensee or licensees business only. Unlawful decoding, copying and distribution will result in prosecution.

We make no warranty or representation, either express or implied, with respect to this software and documentation, their quality, performance, merchantability, or fitness for purpose. This software is licensed ' as is ', and you, the licensee, by making use thereof, are assuming the entire risk as to their quality and performance. In no circumstances will we be held liable for direct, indirect, special, incidental or consequential damages arising out of the use or inability to use the software or documentation.