Our popular spreadsheets available on the Mac platform - Your Annual Licence for just -

Try our Accounting Spreadsheets for Mac Users

they are Easy to use and MTD Ready.

Doing your small business accounts ?

Our Excel Accounting Spreadsheets and Apple Macs are a great combination.

Our Accounting Spreadsheet Templates are widely used by small businesses and self-employed individuals who enjoy the ‘Ease of Use’ and ‘convenience’ of professionally designed accounting software that is built around Excel.

Sold on a Single User, Annual Licensing Agreement.

______________________________________________________

The product range incorporates versions for:

Non VAT Registered businesses

VAT Registered businesses using the Standard VAT Scheme

VAT Registered businesses using the Flat Rate VAT Scheme.

Making Tax Digital for VAT is catered for via an approved ‘Bridging Link’ to HMRC for on line filing.

So, everything a small business needs to maintain it's accounting records is available in one simple template.

Let’s take a more detailed look at the products ...

Software Design and Features

Small Business Accounts Software is designed in Monthly format.

Starting at Month 1 you have 12 identical worksheets covering your Accounting Year. Each worksheet records ALL your business transactions for that month.

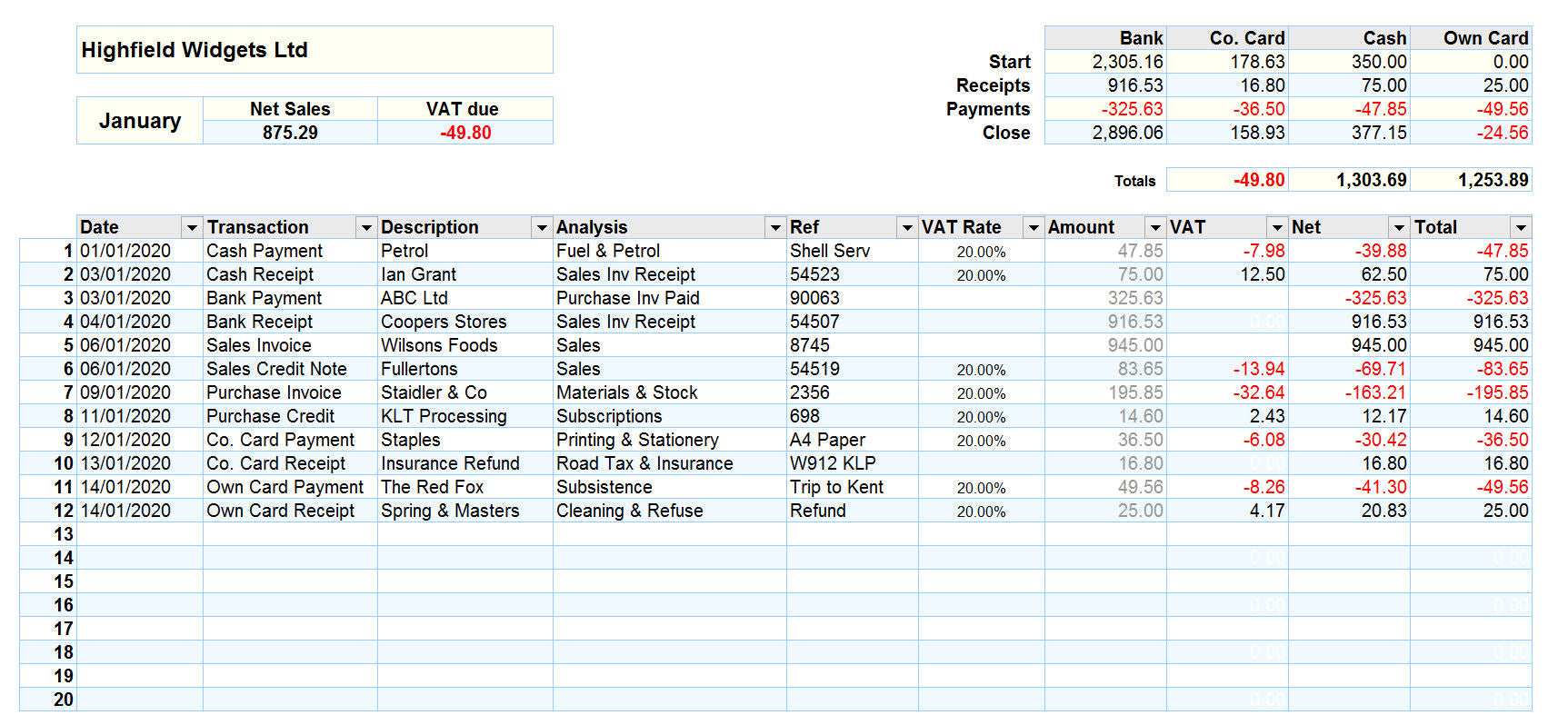

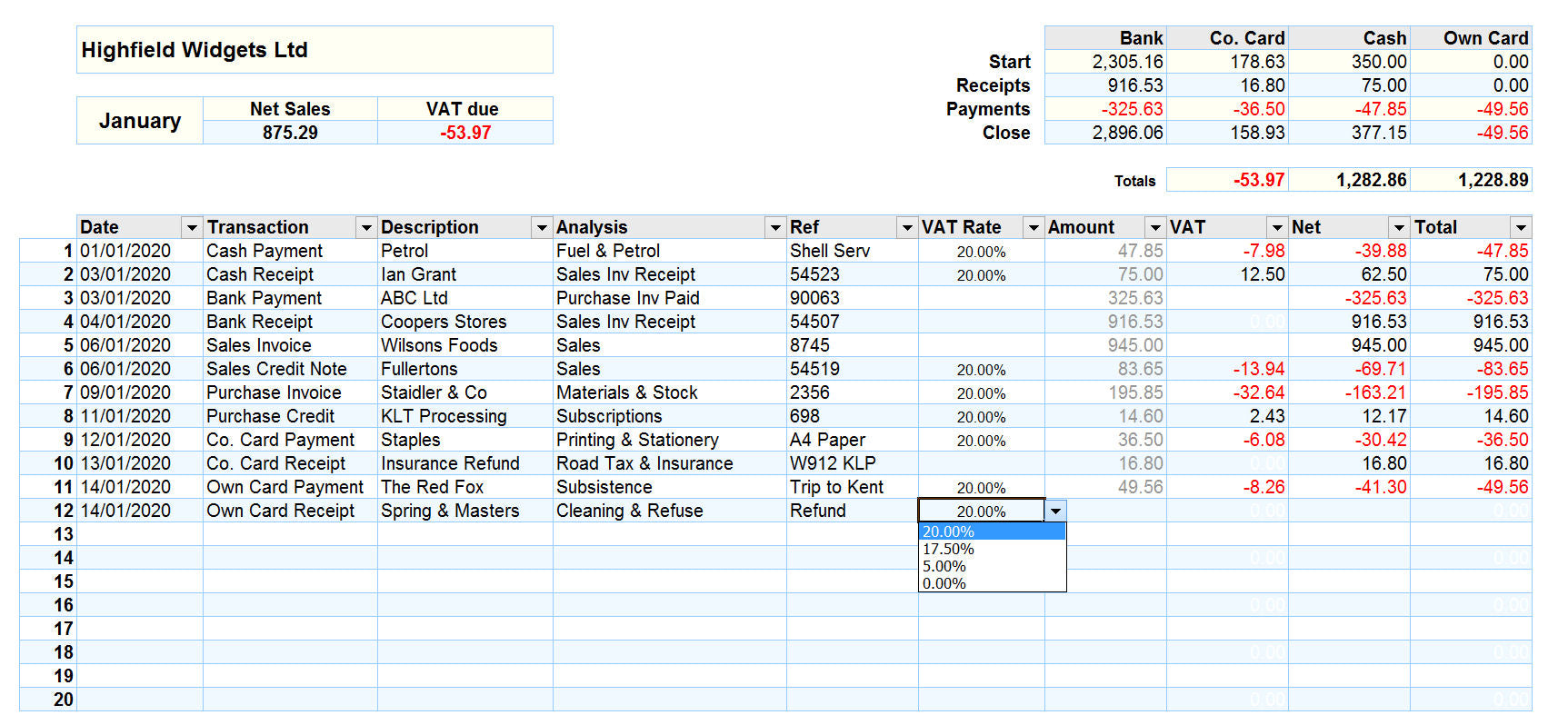

This is what your Monthly worksheet looks like.

It is separated into a Header Section, followed by the Data Section and ends with a Monthly Summary Section.

The Monthly Worksheet

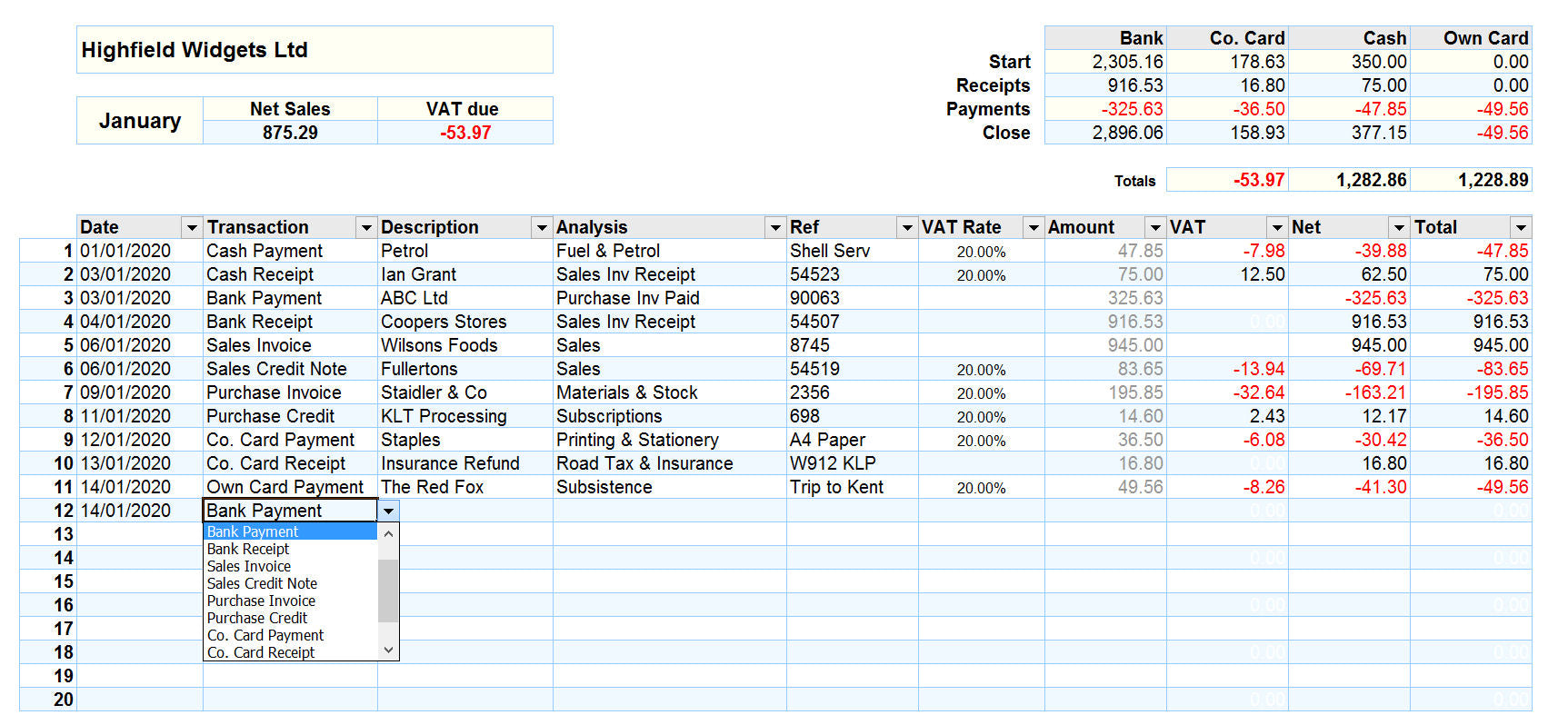

The system uses a combination of Drop Down boxes to make data entry simple and error proof.

Each monthly worksheet caters for ALL your transactions; the software allocates one line to each entry.

You select the appropriate transaction type from the Drop Down Box and then complete the line.

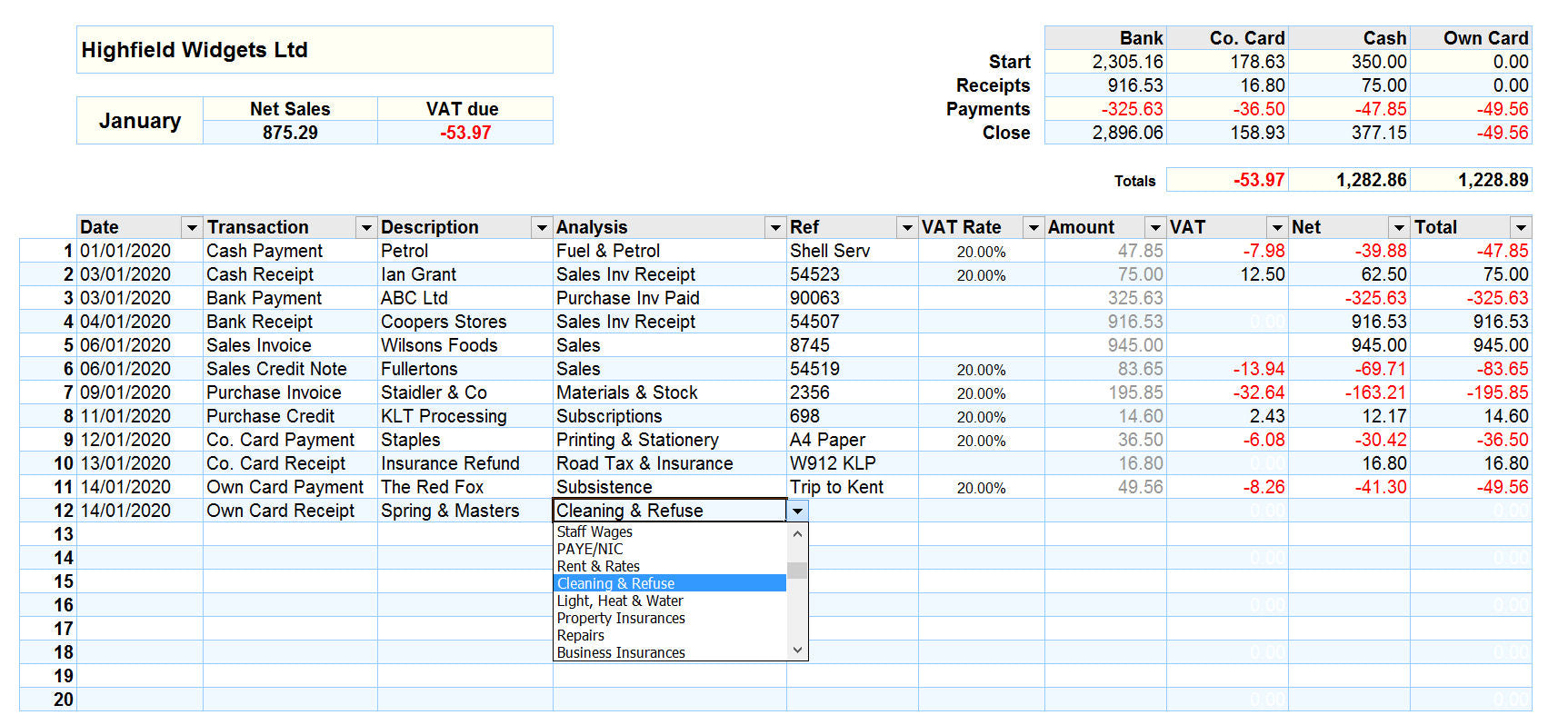

Your data is coded to conform to HM Revenue & Customs formats, you select the appropriate analysis from another Drop Down Box and the software completes the posting. Thus eliminating the potential for errors.

VAT is calculated automatically based on the VAT Rate selected. You have the ability to overwrite the automatic calculation if necessary.

It's that simple !

The following three screenshots show this process.

1. Select your Transaction Type

3. Select your VAT Rate

On each Monthly worksheet you can perform selective Sort routines and use Excels 'Filtering' tool to perform advanced analysis of your data.

Once each line has been completed the software uses Excels powerful formulae to update the following :

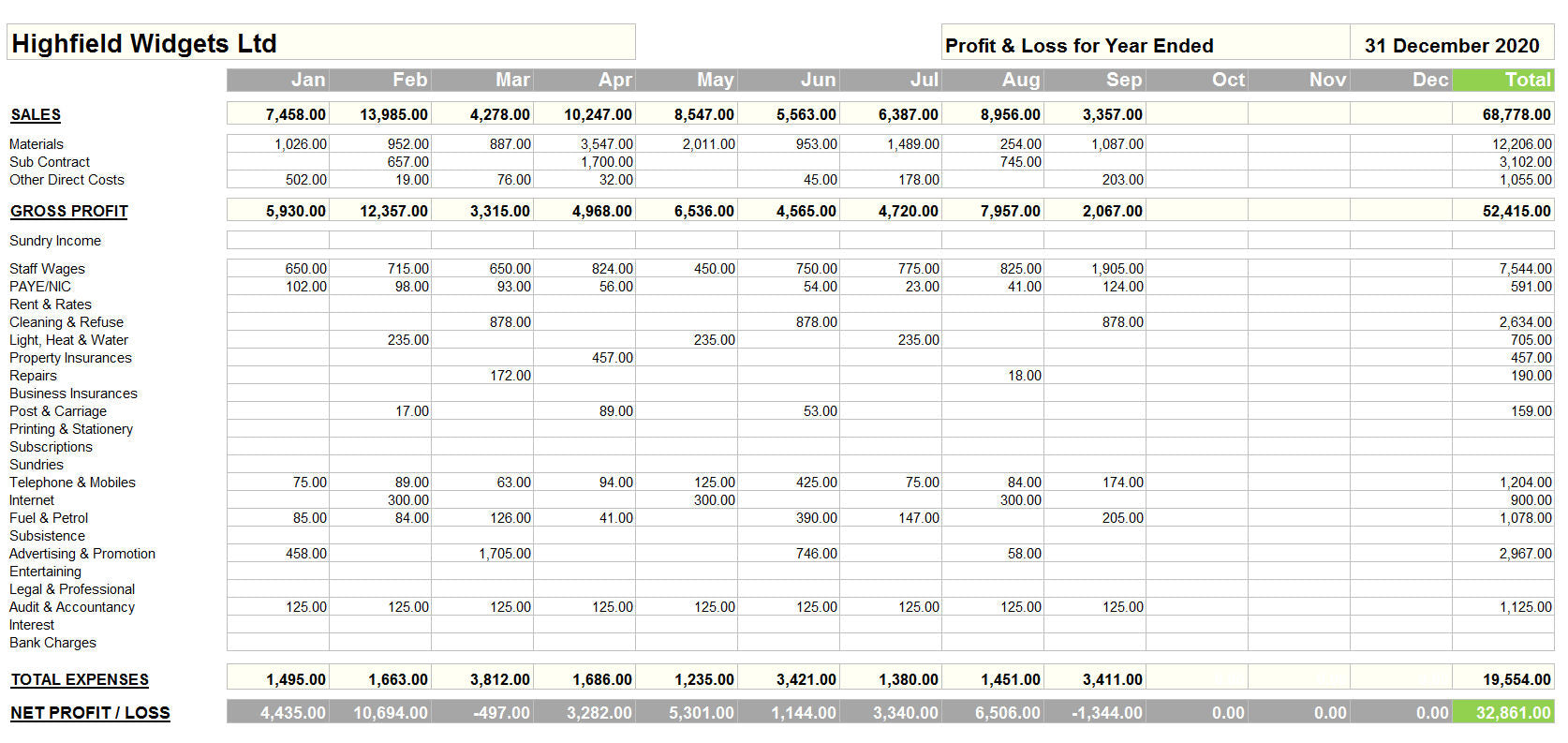

- Income and Expenditure Report

- Monthly Profitability & Sales Summaries

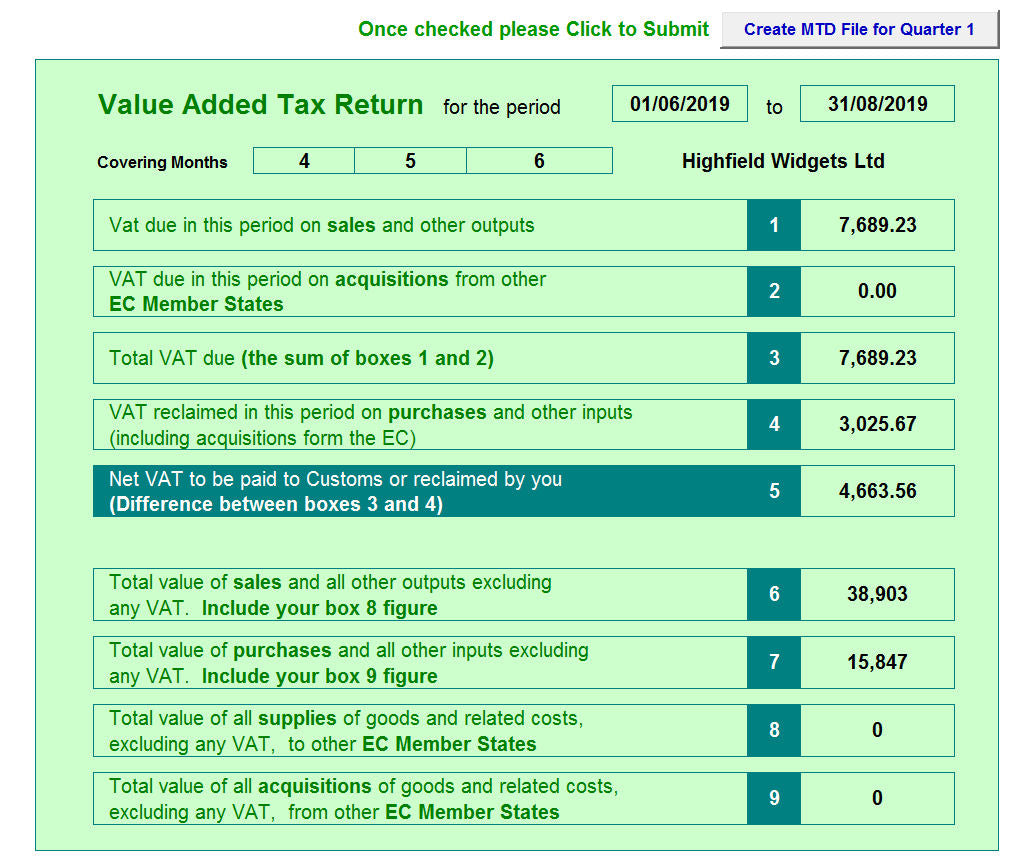

- VAT Returns

- Bank, Cash and Credit Card balances

- Customers & Suppliers balances

(see screenshots below)

Thus ensuring that your accounts are both accurate and up to date.

The software also automatically completes other tasks which provide the following:

- A Consolidated Year's Data worksheet

- A separate worksheet that shows ALL of the years transactions on ONE worksheet

- A special report for your accountants which will allow them to easily upload your data into their systems

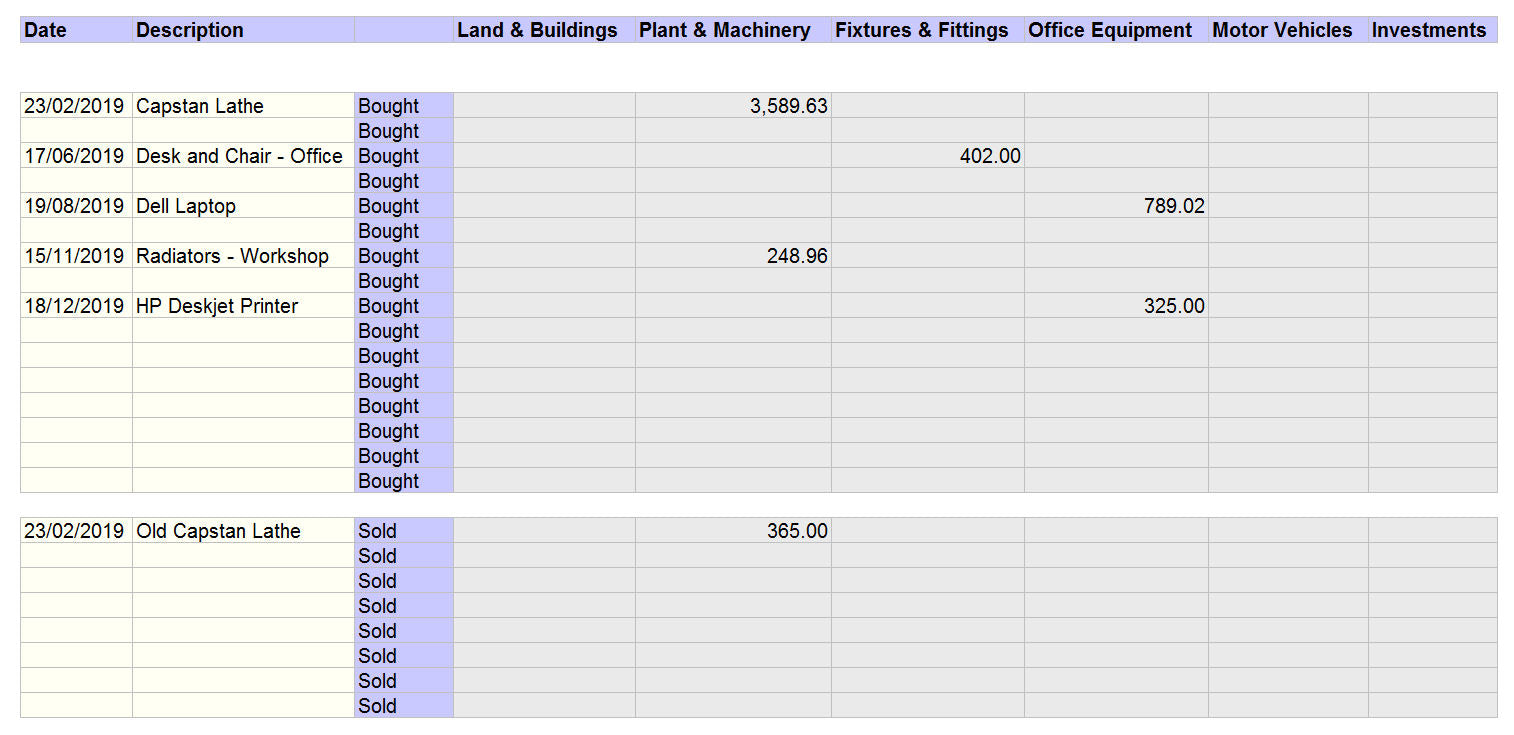

Finally the system provides you with additional worksheets for you to record other financial data for 'Year End' purposes.

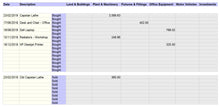

- Fixed Assets Schedule

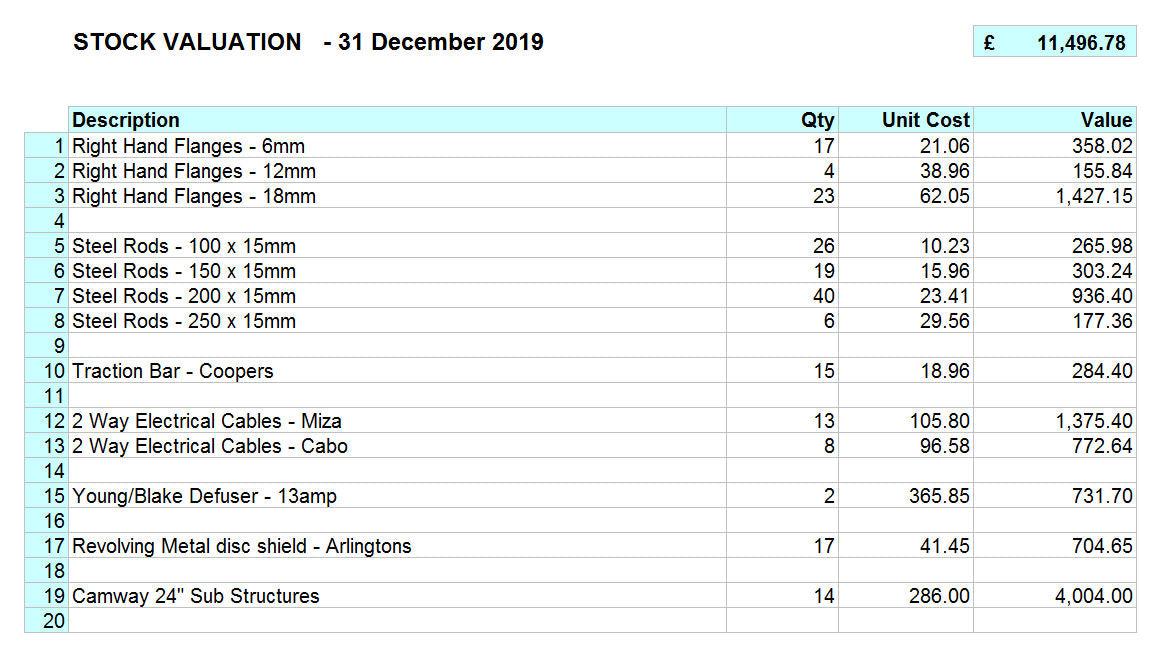

- Year End Stock Schedule

- Year End Debtors

- Year End Creditors

(see screenshots below)

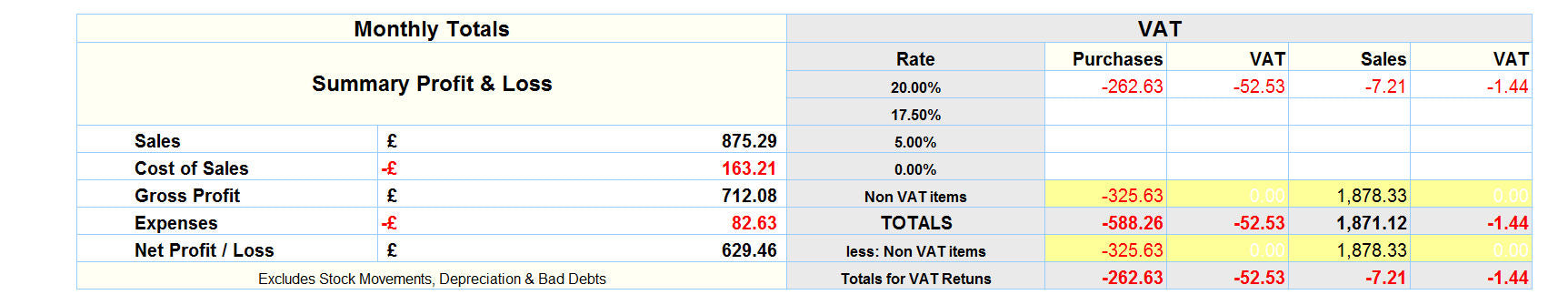

1. Income and Expenditure Report

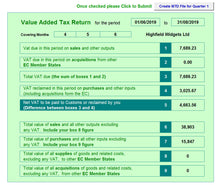

2. The VAT Returns - Now MTD ready

3. Fixed Assets

4. Year End Stock

5. Year End Debtors and Creditors

Set Up, Year End and Backups

Many people are worried about how to Set Up accounting software and are concerned about how to complete the Accounting Year End procedures.

The Small Business Accounts Software manages this with ease.

To Set Up your accounts you just follow the Step by Step guide and fill in the relevant information in the various worksheets. It should take you no more than 15 minutes and then you are ready to go.

At the Year End you need to supply your accountant with additional information, the system notes will guide you effortlessly through providing details of Assets, Year End Debtors and Creditors, Bad Debts and Depreciation.

We have not forgotten the importance of data security; the User Guide provides comprehensive details on how to take regular backups of both the software and your data.

Additional information and small print

This software is protected by international copyright and is sold on a single-user annual licence agreement for the use by the licensee or licensees business only. Unlawful decoding, copying and distribution will result in prosecution.

We make no warranty or representation, either express or implied, with respect to this software and documentation, their quality, performance, merchantability, or fitness for purpose. This software is licensed ' as is ', and you, the licensee, by making use thereof, are assuming the entire risk as to their quality and performance. In no circumstances will we be held liable for direct, indirect, special, incidental or consequential damages arising out of the use or inability to use the software or documentation.